How to Purchase a Payment Stream

One of the most common tools used by brokers and investors alike are the purchase of payment streams or a series of payments. Commonly called a “partial”, this is how it’s done.

How to Purchase a Payment Stream

In many cases, note buyers will not feel comfortable buying an entire note and will opt for a partial purchase. In most cases, this will involve purchasing a series of future payments for a lump sum of cash to the seller. Such “partials” are one of the most important methods of purchase and all investors and brokers should become very familiar with this calculation.

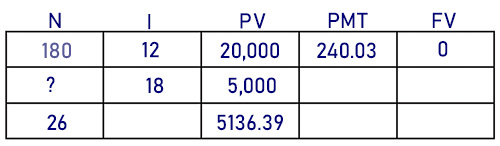

EXAMPLE 1: Roosevelt needs $5,000 quick cash. He owns a $20,000 fully amortized mobile home note with a 12% interest rate that was originated for 15 years. How many payments will you need to purchase to provide Roosevelt with the $5,000 cash?

- First, solve for the monthly payment on the mobile home note. You should come up with 240.03

- Next, change your PV to 5,000 (the amount Roosevelt needs), your I to 18, that is your buy rate, and solve for N which will tell you the number of $240.03 monthly payments you must buy at an 18% yield to give Roosevelt $5,000. You should come up with 25.16 payments.

- In the real world, you would never buy a fraction of a payment. Round the number of payments up to 26 by changing N and then solve for your new PV.

- You should find you will be writing a check to Roosevelt for $5,136.39 in return for receiving the next 26 payments of $240.03 on the note.

It is very easy to purchase payment streams once you determine or know exactly what the payment is.

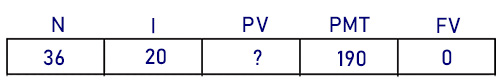

EXAMPLE 2 Your friend Homer who is a mortgage note buyer, needs some quick cash. He comes to you and offers to sell you some mobile home note payments. One of his notes pays $190.00 per month. He offers to sell you the next 3 years (36 months) worth of payments. Your investment rate is 20%. What will you pay for the next 36 payments?

In purchasing the above 36 payments at a 20% yield, you should find you will pay $5,112.53. Or in other words, you will receive the next 36 monthly payments of $190.00 (a total of $6,840.00) for an investment of just $5,112.53 today.