Things are getting tough for small business owners. If you are a reader of high-quality economics blogs, you’ll find dozens of articles authored within the last few weeks that reference an alarming trend: business bankruptcies. These should not be taken lightly, and if you read them closely, you may come to the conclusion that a recession could be on its way.

Small Business Bankruptcies Are Surging

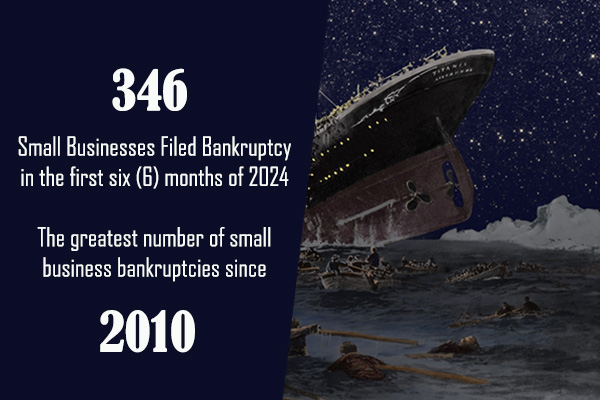

Small business bankruptcies are surging. Now at the highest level since 2010 with 467 filings recorded at the six-month mark, there were 346 companies filed to either liquidate or re-organize through bankruptcy in just the first six months of 2024. In fact, from data provided by S&P Global Market Intelligence, last month alone, some 75 new bankruptcy filings were recorded, which was the biggest monthly total since early 2020.

Economists and investors reporting to news outlets such as CNN that the majority of insolvent businesses reaching for bankruptcy protection would be categorized as “consumer discretionary.” These companies would feature businesses that are consumer-oriented small businesses and sell goods or services that don’t need to be purchased every day. These are businesses such as restaurants, apparel stores, auto parts, etc., and most of the businesses are truly considered small or mid-sized.

Is Your Small Business Taking On Water? It May Be Time For You To Investigate DIP Financing!

What is it, and where can I get some? DIP financing, or Debtor-in-Possession financing, is a type of funding provided to companies undergoing Chapter 11 bankruptcy. DIP is often critical to a small business’s survival when facing insolvency. DIP financing allows the bankrupt company to continue its operations during the reorganization process. DIP financing is typically granted higher priority over existing lenders and debt, giving such lenders some confidence that their loans will be repaid.

DIP lenders to a company are often new lenders who specialize in DIP financing. These lenders understand the unique risks and opportunities associated with lending to companies in bankruptcy. However, existing creditors can also become DIP lenders, especially if they want to protect their current investments and have confidence in the company’s reorganization plan.

Does Your Business Operate B2B? Explore Factoring Your Receivable Under DIP

For B2B business owners facing Chapter 11 bankruptcy, maintaining a steady cash flow while navigating the reorganization process is critical. The ability to get paid quickly by customers can make the difference between a successful restructuring and a failed business. However, demanding faster payments from customers who have been loyal over the years can strain these important relationships and potentially drive them away, exacerbating the company’s financial difficulties.

Factoring provides an ideal solution for small B2B operators needing DIP financing during bankruptcy. By selling their accounts receivable to a factoring company, businesses can receive immediate cash without altering their customers’ payment terms. This allows the business to continue operations smoothly, covering necessary expenses and stabilizing its finances while avoiding the risk of alienating customers.

For companies in Chapter 11, factoring can serve as a bridge to stability. Factoring firms advance funds based on the value of the receivables, which can be used to meet urgent financial obligations. This arrangement ensures that businesses have the liquidity needed to operate and re-organize effectively without the delays associated with traditional lending.

Facing Some Tough Decisions? Prepare Early and Find a Factor

Commercial factoring is one of the most widely used financing tools by B2B business owners facing bankruptcy. The GOOD NEWS is that hundreds of domestic factors have the experience to provide DIP financing to assist in helping you and your business return to financial health. And, more good news is that you can easily locate commercial factoring companies that routinely provide DIP services for companies just like yours at the Directory of American Factors and Lenders.