Learning Lab

Understanding Your Factoring Commission Reports

Lesson Video

Commission Report Example

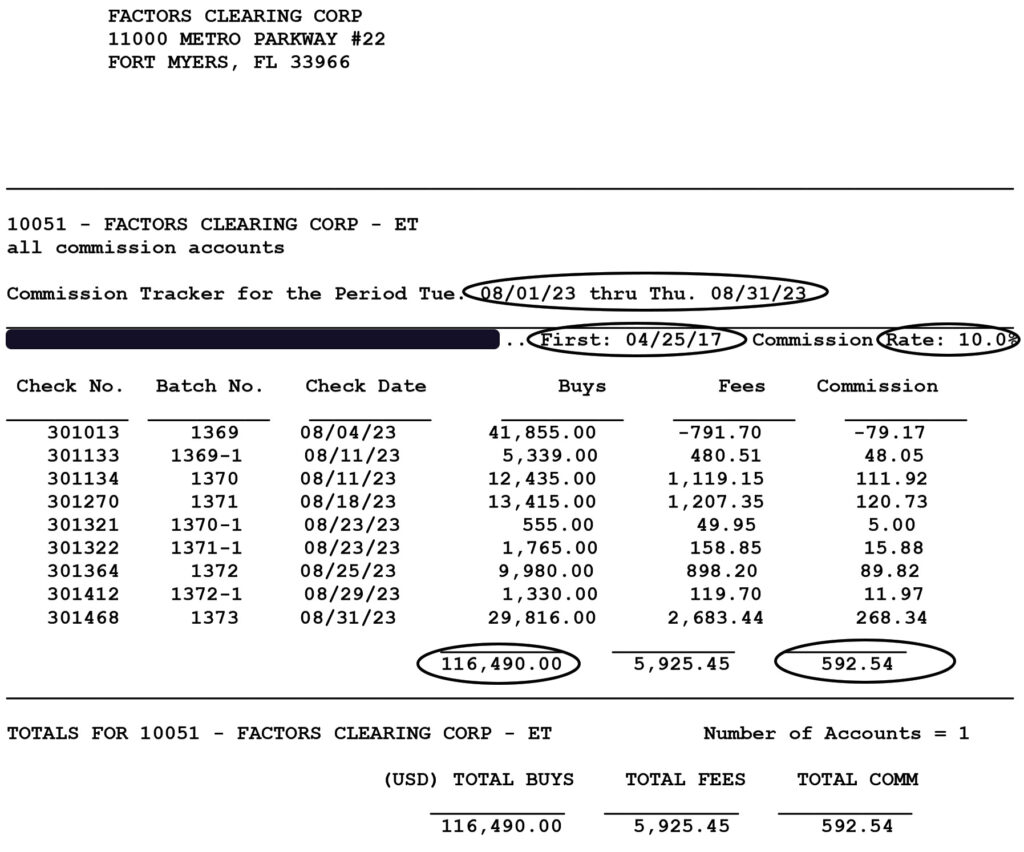

- For each client that you refer to a factor, you will receive a monthly commission report that will document your earnings for the month. Factors do not typically just provide you a payment. In most cases you will receive a “Broker Commission Spread Sheet” that details…

- The Account Name and Date

- Commission Rate

- The “Buys” or Invoices Collected Upon

- Total Fees earned by the factor

- Your net commission based upon your commission rate

Commission Reports

When viewing the IACFB’s Directory of American Factors and Lenders, you will immediately notice the MAIN SEARCH BAR in the middle of the website’s home page. The MAIN SEARCH BAR offers 5 choices or options of lender categories. They are…

- Commercial Factors

- Asset-Based Lenders

- Alternative Commercial Lenders

- Equipment Finance Company

- Brokers and Consultant

The SELECTOR of the search bar defaults to search and access commercial factor listings. You will notice that the listing has a WHITE BACKGROUND. If you are seeking another lender type, such as an asset-based lender, position your mouse pointer over the Asset-Based Lenders listing and logo and click your mouse to move the SELECTOR.

Once you have selected the type of lender you are seeking, then click the PURPLE Search Button to display all of the basic listings of all lenders in that particular category.

Commission Report Example

- Commission Report Date: August 2023

- Client was Sourced on 04/25/17. Broker has been earning monthly for over 7 years

- Rate of Commission: 10% of the Factoring Fees Earned

- Invoices Collected Upon: Fees earned on $116,490 for Augusr

- Commission earned of $592.54

How to Estimate Your Earnings

Although factors can provide different style reports, most will provide at least the above details. Additionally, invoices purchased for clients differ month to month. However, this client has utilized factoring for over 7 years. If on average, the monthly commission was approximately $600, this single brokered account which financed a little over $116,000 in invoices, would provide over $7,000 in income to the broker. To reach the threshold of $100,000 in annual income, you only need to develop 15 such small business clients.